General Discussions

This is a place for short / non-specific discussions about constructing portfolio or researching about companies. Serious stuff only!

165 Replies

How to construct a stock portfolio ? Are there any frameworks? @vineetr

Or maybe how not to. Recently I am seeing some totally random portfolios in friends and families accounts. Horror and utter amazement are the only things I could do.

In theory, most of the folks recommend creating a diversified stock portfolio. That usually involves looking for correlations across stocks and deliberately investing in stocks that don't mirror each other.

You can ignore correlation and diversification, to get higher returns, but that also comes with higher risk, specifically higher draw downs.

This article shows an example of correlation analysis

https://www.investopedia.com/ask/answers/032515/what-does-it-mean-if-correlation-coefficient-positive-negative-or-zero.asp

Investopedia

Correlation Coefficients: Positive, Negative, and Zero

Correlation coefficients of greater than, less than, and equal to zero indicate positive, negative, and no relationship between the two variables.

You'd generally want to run correlation analysis on a specific stock against Nifty50 or Nifty500

Most poorly constructed portfolios have negative correlation most of the time with Nifty, meaning they lose money most of the time when the market is going up.

Negative correlation is fine for contrarian picks that start performing when the market does poorly. But I doubt that's how the contrarian pick was made in the first place

How about doing a sectoral diversification and taking exposure to each sector by selecting representative companies? Like you did with rice sector.

Like analysing and calculating that 5% exposure to rice sector would be a nice bet. And then analysing the rice companies and finding 2-3 decent ones and letting it work out.

Can this be done for the whole portfolio? Is that a way you construct yours ?

So, when doing correlation analysis, you should ideally not start with a single stock. You could but that's moot for this discussion.

You do the correlation analysis to figure out how sectors move along with the broad indices. You'll find that certain sectors do well at certain times only.

Once you do correlation analysis of sectors or industries, you'd kind of know how much to allocate to each sector.

You can go further into the subcategories for each sector. Like chemicals is very broad, and you'll want to choose between speciality, diversified and generic chemical companies. Same with Pharma and other industries.

Once you figure out which sectors are worth investing, you can start looking at the investible companies in those sectors

Hmm. So pretty much adding the sectoral correlation with indices and then doing what I wrote.

Indices - sectors correlation, and then once identified which sectors and how much under or overweighting wrt index, take exposure to investible companies in that sector. Repeat for each sector.

Sometimes there's a chance that certain sectors are over or underrepresented in the indices and stock markets despite revenue growth or profitability or lack of those. Like AI for instance of under representation, or PSBs as over representation.

This sounds much better than individual random companies investing based upon zilch.

That's the trigger to look for alternative investments. Different concerns with those

Is it a good idea to copy someone’s (some MF) portfolio to build a paper portfolio and then build upon that on own ?

Maybe even the NIFTY 50/100 to build a base.

Within sectors as well should one look for subsector being undervalued/overvalued or should one think sector as a whole and make conclusions. Case in point is rice could be cosidered as a subsector of FMCG. But almost various subsectors and companies (barrig rice which are still in P/E around ~15-20) of FMCG is almost above a median P/E of 50+. So how to conclude that if a sector or a subsector is undervalued or overvalued or there is no headwinds for that one particular sub-sector?

I would assume that here there is role (?luck) of how much calculated bet you are placing and if that would work out in future.

How to actually say what should be my position size? (I had said this few days back). I used to be sometimes very certain that a certain company or a sector is really undervalued and the company is doing good. Still couldn't make huge investments. Is it just psychology playing out like what if the stock falls too much or is it safe not to invest on them for a while? (Basically averaging out is better when stock moves down or wait and watch thinking market knows something more than that i do?)

If you start looking at portfolio holistically, then you will get over this. And of course it takes time (in the markets) to understand this. Basically, you are in analytical mode rather than emotional mode.

You can start with index but almost always will need to remove some companies and add few others.

Yeah, something similar was the reasoning to buy rice stocks. If you look at the global consumption of grains, rice and wheat are up top. Yet, the FMCG companies in the index had supply chains mostly around wheat processing. Basmati rice is a smaller segment of rice consumption, but there was a branding play already in place. So, it becomes a two-fold investing story - you need exposure to an FMCG play around rice, and the undervaluation relative to other sectors and companies should give a valuation comfort. None of the rice stocks are true FMCG plays even today.

By the way, all this talk about correlation analysis will eventually lead you to discover Modern Portfolio Theory. https://www.wallstreetmojo.com/modern-portfolio-theory/

Ashish Kumar Srivastav

WallStreetMojo

Modern Portfolio Theory

What Is Modern Portfolio Theory? An investment model like modern portfolio theory or MPT allows investors to choose from a variety of investment options

Nothing modern about it. Its been there for around 50 years or more. Its has its fair share of criticism as well. You can avoid the problems with this theory, by always re-evaluating the relative sizing across sectors and companies, using revenue, profitability and margins as a basis.

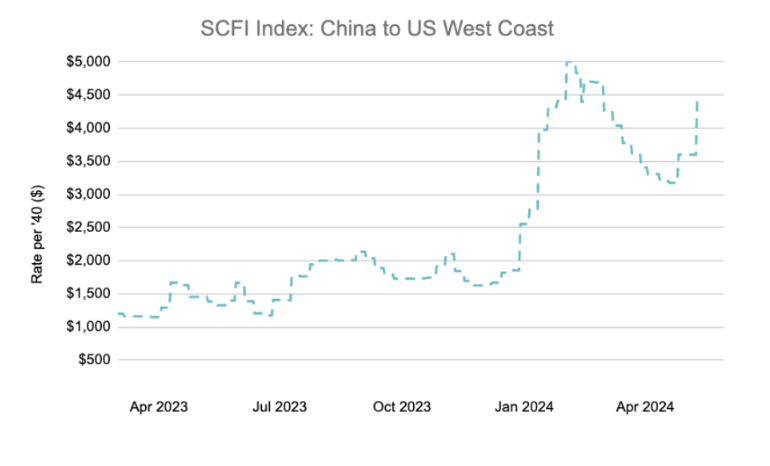

@vineetr what is your summarised view of the shipping sector right now? update since last time (long time back).

I would start by looking at Baltic Dry Index, and see where we are relatively speaking. Cost of shipping is influenced a lot by supply and demand of shipping tonnage first, and energy prices secondarily, under current status quo (oil/gas powered container and cargo ships).

Baltic Dry Index is nowhere as high as the peaks we've seen 15-20 years ago. It's expected to go up primarily because of Middle East conflict. In the absence of that conflict, it can easily fall back down, since most analysts predicted the index to end at 1400-1600 this year; its currently at 2200ish.

how do you take exposure to that sector? go international (because that is where all the big players are) or go local only.

Going local is sufficient, if want just some exposure, but local plays arent highly correlated with that index. So, you don't see a stock in the shipping sector like GESHIP have rapid swings in share price based on that index. There is some correlation, but it's not very strong.

Going global on these plays is a double edged sword though - the global players might see a revenue and expense (insurance) risk first, before seeing a high transportation rate contribute to higher earnings. Higher shipping rates tend to hit utilisation. Lot of debt in some of these plays makes me wary to step into these waters.

The other related play is ship builders who start benefitting from the need to fulfil supply if BDI goes high over a prolonged period of time, but none of our ship building yards can compete with the Chinese, Korean and Japanese players for container or cargo plays. Not yet.

I took exposure to GESHIP about a month back. Very small exposure

Will increase allocation if I develop the conviction it will beat NIFTY500 returns over 12+ months

why do you care about 12+ month game?

if something gives bumper across bad times, then those are going to be great.

Because then I need to factor in timing, and create a separate trading strategy for this play

both Panama and Suez are not working well presently. which means that containers and tankers are at premium rates.

Weak correlation as you can see.

pretty much.

Yeah, I know. Thats why GESHIP has been moving up slowly. But see Maersk. Its a listed play, and its moving in opposite direction 😬

If the largest listed player is acting up like that, something else needs to be factored in

because our problem is that our players are small in the grand scheme of things

Thats why I doubt they will get the full benefit of an increase in rates

Still studying up how GESHIP is negotiating contracts

You wont see an immediate bump in revenue

they won't. which is why my first question was how to take exposure to global shipping sector

Because some of the contracts are going to be locked in at historical rates

Its the new contracts at higher rates that matter

Its not like a spot market for all the shipping volumes

and there is no new supply.

Demand is there, and will only increase.

i suppose that is a very sweet spot, if you can go through the short-term volatility, because ultimately you are going to make lot of money

Yes, and based on the rates, the shipping fleet owners may have to fulfill existing demand at higher expenses, and bear the costs until they can renegotiate rates.

Thats why the spot market is not a great leading indicator for certain companies

no supply, lot of demand. non-fashionable sector.

i guess, there is no alternative to IBKR.

GESHIP is 25% up since I entered. 💀

Time to correct the mistake of having a small exposure.

@reo_sam Latest Maersk report - https://investor.maersk.com/static-files/deeb9c9c-7fda-46bf-849a-271d3a2e5056

This commentary was made in Nov. Rates might rise now with this rerouting, but at the cost of volumes.

HDFC sec has option for global investing through stockal (ultimately Drivewealth). Have you checked that? @vineetr

I can do IBKR through Kotak, I think. They introduced this a few years back

Need to get all that activated though

Stockal is doing it for US bourses.

Indeed.

IBKR india can trade on NSE also (1bps). not a bad choice to have as a single broker

did you check?

i am evaluating indmoney, groww and IBKR

That option is there, but need to figure out what to put in foreign portfolio. Remittance charges and TCS are a killer. Will be going slow on the foreign portfolio.

TCS applies at 7L in a FY.

6,99,999 in this year and next FY should make it 14L almost without TCS.

hopefully, next govt may turn it back or reduce it or increase the limit.

7L is nothing in terms of investment amount for me

For me, that amount is close to the entry level amount for any single stock.

so 2 stock positions. without TCS.

after that, hopefully TCS goes away.

The Edge Malaysia

Shipping costs soar as war and climate risks choke key waterways

Global shippers of crude and fuels are grappling with a spike in booking costs for some tankers taking lengthy diversions to avoid disruptions at the Suez and Panama canals.

predictable.

this is what is pulling me in.

"greed"

both Tankers and containers will mint money. Former having done since some time. Latter sooner or later.

This availability issue is expected to affect retail consumers in Feb. So around 30-45 days.

Even if the West forms a naval coalition to deal with the problem in Middle East, there is likely to be a backlog in ports and warehouses which will take some time to clear. Supertankers will help only with certain types of loads. Orders for Suezmax carriers were on the rise prior to this, but new ships wont be on the market any time soon; takes about 3 years or more to build one.

Shippers are also going to operate in their best interest. They would have started negotiating rates. If none of these materialize in next quarters earnings, we can see smart money leave the table.

IBKR does only margin trading account on NSE. and cash on international. I have never done trading on margin. What exactly is that? @vineetr

Depends on product you want to trade, the exchange where it is listed, and the regulations around that. https://www.interactivebrokers.co.in/en/trading/margin-requirements.php

Margin Requirements | Interactive Brokers India Pvt. Ltd.

Use the IBKR Margin Requirements Wizard to see what requirements apply to you. Also view info on the exposure fees for high risk accounts.

So basically, I purchase 1L worth stocks, and pledge them same day. Pay up same day from bank account. From second day, they charge interest money and square off after t+4/6 days. Is that right?

I believe this means you need to pony up all the money upfront before a trade, so no different from Zerodha. But better to check with someone else if that is true

They also seem to have a USD 2000 minimum

Seatrade Maritime

The best way to value shipping equities?

What is the best way for investors to put a value on shipping stocks? At a time that the dynamics of listed companies are in a state of flux the question is an important one.

@reo_sam An article covering a new way to value shipping stocks. Typically, NAV per share is used

thanks. will go through it.

Mehrotra, stressing the importance of bigger players with clean balance sheets, at a time that emissions regulations have effectively created barriers to new entrants, suggests such considerations get ahead of pure cyclicality.I am of this view too. No new supply, so current players have a "moat" around them.

@reo_sam Maersk Q3 report from early November.

Relevant part.

I guess I can buy Maersk!

Only the price is $$$$

Actually, this would be the reason to not go aggressive on it. Further demand collapse can happen, since shipping companies will just transfer the costs to the end user.

A rising cost of shipping with rising interest rate regime is fine. But the interest rates have peaked according to more central banks, so an offtake in shipping volumes wont happen for sometime.

I am neutral about interest rates. They may and should rise some more. Not a peak

Also, check this site out https://www.marinetraffic.com/en/ais/home/centerx:164.2/centery:16.0/zoom:2

MarineTraffic: Global Ship Tracking Intelligence | AIS Marine Traffic

MarineTraffic Live Ships Map. Discover information and vessel positions for vessels around the world. Search the MarineTraffic ships database of more than 550000 active and decommissioned vessels. Search for popular ships globally. Find locations of ports and ships using the near Real Time ships map. View vessel details and ship photos.

Helps track maritime traffic. There are container and tanker ships using the Suez

Better to monitor this weekly. Big changes in the China to Europe traffic are the ones to watch out for

Use of this route needs to reduce by a lot.

Maersk is planning to slowly move back to the Suez route. Not sure when they'll start to reroute

These charges should go away soon. Doesnt look like customers like this.

https://www.reuters.com/business/maersk-imposes-container-surcharge-due-diversion-red-sea-2023-12-22/

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Its contextual. Blindly looking at historical underperformance wont help much. There might be a reason for the market to revalue certain sectors despite underperformance. Then the temporary underperformance becomes a permanent one.

Its more important to understand how smart money views sectoral valuations, and then take sectoral calls accordingly.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Reliance is undergoing management transition at the top, in case you havent noticed.

HDFC has undergone a merger, and needs to prove consistency again, after Aditya Puri's exit

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Depends on valuation. What you see as consolidation, is basically the market repricing the stock over a period of time.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

https://www.oaktreecapital.com/insights/memo/easy-money

The upshot of my sea change thesis is simple:The period from 1980 through 2021 was generally one of declining and/or ultra-low interest rates. This had profound ramifications in many areas, including determining which investment strategies would be the winners and losers. That changed in 2022, when the Fed was forced to begin raising interest rates to combat inflation. We’re unlikely to go back to such easy money conditions, other than temporarily in response to recessions. Therefore, the investment environment in the coming years will feature higher interest rates than those we saw in 2009-21. Different strategies will outperform in the period ahead, and thus a different asset allocation is called for.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

fundooprofessor

Fundoo Professor

Teaching Note on Cochin Shipyard

I go to Flame University every year to teach undergraduate students a course called “FINC362: Case Studies in Business and Investment Analysis.” These case studies are based on real businesses; som…

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Because Maersk is a proxy for global container shipments. The Red Sea shutdown came with two consequences - 1. increase in expenses in immediate term due to longer transit times while not being able to transfer the increases immediately

2. Unknown effect on long term (1/3/5 year) earnings, because the duration of the shutdown is unknown coupled with no near term triggers to increase earrings.

For a company like Maersk, global economic recovery is way more important. Basically, shipment volumes and shipment rates have to both increase on a sustainable basis. Their recent management report is linked above in the channel.

For GESHIP, the earnings are increasing due to repricing of their contacts. That's getting muddied by the global shipping chaos.

It's important to know how the shipping contracts are structured. Long term contracts need not be influenced by the shipping exchange rates for Suezmax, Panamax, capemax or any other category. There is some influence, but managements will not aggressively seek repricing because it affects credibility, and it opens up the subject for buyers to also seek repricing whenever it's in their favour.

There is also a possibility that short term investors in GESHIP are ignoring all of this, and just moving the price up due to availability of liquidity.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

1. How do you pick or come across sectors. While sectors like EV/ related is always hyped up or everyone is looking at, others like maybe rice or sugar aren’t as commonly discussed.Either absolute numbers of revenue or revenue growth. It always starts from there. Absolute numbers matter, because they'll give you a t-shirt size for the size of the market. Revenue growth in percentages matter because you want to find growing companies. The first sign of growth is always in the top line. Earnings growth, which investors should care about, comes from either growth in revenue (topline) or improvements in expense management (bottom line). When it comes to preferences, investors prefer to see a company grow top line because then it's trying to grow market share. Once market share has stabilized then it makes sense for the company to focus more on the bottom-line.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

If you want to figure out how to spot a theme like EV, this is your answer. Very unlikely that unlisted players stay entirely away from something new. Existing listed players can invest into new themes to protect their existing markets or to grow into new markets.

Top down analysis of revenue in a market. All revenue is reported to the government, for taxation purposes, either for consumption tax (GST) or for profit.

You can create a screener to check for companies that are reporting sales growth. But it may not give you a structured way to look for a theme. Themes are constructed from numbers, so the numbers need interpretation or you'll fail to spot flaws in the screener.

For example, companies can grow by discounting their products, or by changing revenue recognition practices. One of these could be seen as fraud. The other is likely to result in a deteriorating balance sheet unless there is a strategy at play. As an investor, it's important to make sense of numbers.

An example of a screener.in filter for this. Can be tweaked further.

Sales latest quarter > 1.1 * Sales preceding quarter AND Sales latest quarter > 1.2 * Sales preceding year quarter AND Sales > Sales last yearWhat this checks for is YoY of 20% and QoQ of 10% sales growth. Sometimes checking forQoQ growth is enough, but you could fall into a growth trap or a cyclical trap.

How to delete certain companies at this point and pick out companies that aren't totally cyclical in nature or sales growth being at peak once in a decade or five years kinda phenomenon let's say within a sector? (Example people are doing something like order book investing in railway and some PSU stocks in recent times). Is it better to assume that kinda sales growth and profit growth is sometimes sustainable for longer than we assumed?

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Order book is not a GAAP measure, so its difficult to create a filter in screener.in. May exists in Bloomberg or some other expensive offering.

Cyclical companies can be filtered out by looking at the source of the sales growth. If the source is some cyclical uptick in some product sales, its relatively easy to mark that as a cyclical story, which needs to be treated differently.

Generally in case of PSUs, the government policy direction and execution matters way more than some GAAP measure. GAAP measures are after all not forward looking, but policy direction is.

Yes. Its one way to structurally look for ideas. Sometimes stock screeners should be used for idea generation, rather than to actual filter in/out companies.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Just putting it in unstructured manner but hope others could say better ones :

1. Investopedia (not very structured but look at corporate finance subtopics) for term by term definitions with examples (and basic understanding of financial terms with there implications on broader scale but you need to structure it yourself overall),

2. screener for getting numbers on company to company basis,

3. Dr. Vijay Maliks blog (for sectoral analysis and some company analysis - could use it to get a gist of how to pick things on company to company basis. Started recently but really worth reading it),

4.VP forum for further understanding and general understanding of a company (i would call it a gold mine and you could come accross every set of investors and if you want to read entire company history).

4.VP forum for further understanding and general understanding of a company (i would call it a gold mine and you could come accross every set of investors and if you want to read entire company history).

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

https://www.valueresearchonline.com/stories/54205/why-are-these-kfc-moguls-dishing-out-different-profits

Article covers the difference in balance sheets between Devyani International and Sapphire Foods

@. Remember the discussion around Whirlpool parent reducing stake in their subsidiary?

The Economic Times

Whirlpool Corporation sells 24% stake in Indian unit for $468 milli...

Following the sale, the parent firms holding has come down to 51% from 75%. The American consumer durables maker expects to use the proceeds from the stake sale to reduce debt.

Stock as expected hasn't reacted well. Mutual funds picked up stake. Now depending on subsidiary's performance, the stock may do better, or it will start behaving like a laggard.

Could parent increase stake by buyback in future if it's subsidiary does well or is there any restriction on that (by SEBI or any regulatory authority) in terms of time period from which they decreased there holdings to time when they plan to increase there holdings?

Let's say they cut down there stake for now and stock price goes down. Again the parent starts increasing there ownership when stock hits lower price. Is it a possibility?

There is a regulatory need for parent to announce an increase in stake, and they can increase shareholding only by 10% in a year.

Moneylife NEWS & VIEWS

SEBI allows promoters to increase stake by up to 10%

Stock market regulator, Securities and Exchange Board of India (SEBI) has amended the takeover norms to allow promoters to increase their stake by up to 10 per cent through a preferential allotment.

There are a bunch of similar regulations for shareholders with large stakes. There is a need to announce an open offer to buy shares, once you reach a minimum limit.

from here - https://www.sebi.gov.in/sebi_data/faqfiles/mar-2022/1648620806406.pdf

You'll notice that mutual funds usually hold less than 5% stake due to above reason

Some shady promoters also limit stakes of related shareholders to less than 5% to avoid the open offer process

Open offers tend to invite a lot of scrutiny, especially due to sudden increase in shares held by a single party.

So there is less chances of manipulation at this point (by owners). Overall i would still consider this huge red flag if promoter himself is selling too hugely or is it something that i needn't look into?

For an MNC, selling a stake is not a good thing. Sends a signal to the rest of the market that they're not serious about the prospects of the Indian operation.

Enough MNC stocks have languished due to said concern

@alien Regarding Samhi Hotels - https://www.capitalmind.in/2024/02/samhi-hotels-analysis/

Looks like a lot of investors are seeing the company performance post-IPO. Something similar might happen in Juniper Hotels which is also into a similar play, but there is some management quality concerns there.

Capitalmind

SAMHI Hotels: Playing the cards right in a growing market with fina...

With hotel demand expected to increase in the next few years, SAMHI Hotels emerges as an exciting new player on the scene. If its management walks the talk, the company could take advantage of the growing market, along with financial and operational leverage, to succeed. Read on.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

The investments made by someone else, no matter how close they are, should only be a source of ideas. Your investing style seems to be ride the coattails of other investors. It is a part of a valid investment strategy - https://www.investopedia.com/terms/c/coattailinvesting.asp

Where you can go wrong, is in the borrowed conviction. The whale investor whose coattail you want to ride, would have his own set of convictions to invest in the stock. He/she may exit at any point for a myriad of reasons. It's possible the stock crashes after the whale exits his/her position. It's also possible it gets greater attention and gives market beating returns afterward.

If you just want to ride coat tails, then buy when the whale buys, and sell when he exits. Your returns aren't going to be very different from the whale.

But if you decide to become clever and start doubting the whale, then you need to see the whale's investment as just a source of ideas, and you need to develop your own conviction in the stock, and your own investing style.

Investopedia

Coattail Investing: What It is, How it Works, Example

Coattail investing is an investment strategy of mimicking the trades of well-known and historically successful investors.

Investopedia

How to Be the Perfect Copycat Investor

Legendary investor Warren Buffett has attracted many copycat investors over the years. Does replicating investment ideas of famous investors pay off?

According to a 2008 study by Gerald Martin and John Puthenpurackal, a hypothetical portfolio that invested in Berkshire Hathaway’s investments a month after they were publicly disclosed would have outperformed the S&P 500 by an annual average of 10.75% from 1976 to 2006. But before you rush off to check Buffett’s current holdings, consider the other side of the coin, when a long streak of outperformance ends with a resounding thud. Fund manager Bill Miller joined the pantheon of great investment managers after his Legg Mason Value Trust Fund beat the S&P 500 for 15 years in a row, from 1991 to 2006. ... Investors who had mimicked Miller would have rued their decision if they had continued to do so after 2006. Miller eventually opted to step down from managing the Value Trust Fund in 2012.@agent_style 👆

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

High promoter holding is not always seen as a positive.

Promoter quality is a large topic. Will avoid going in depth into that, because it would require long-form writing.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

By and large, the first parameter to look at promoter quality is earnings and earnings growth. You don't want to stick around with promoter who make losses, and never learns. Making losses and learning from those is fine, but a track record of making losses and not learning from it, is a track record to avoid.

The parameter that follows is the vision around earnings. This is partially a transparency aspect - not all promoters communicate effectively about how good the earnings are, and how sustainable they are. There is also a long-term strategy aspect to it. Most large and mid cap companies operate with a short-term strategy with an annual planning exercise. They may also have a long-term strategy at play with a time horizon of 3-5 years. Communicating this effectively is sometimes necessary when companies choose to go for losses in the short term, in order to gain an advantage in the long term. The company, in order to operate as a going concern, will sometimes sacrifice profitability to ensure it has all the necessary investments being done to ensure long-term profitability. You'll see this in cyclical companies - sure they can reduce expenses in a downcycle by doing a lot like laying off staff, reducing inventories etc. but that prevents them from doing better when the upcycle starts. Some investors may not like it, especially if their investment horizon was shorter than the time needed to realize the company's vision.

One note on the profitability front - more nuanced investors look at whether companies segregate their expenses into fixed costs (office, equipment R&D etc) and variable costs (loan interest, inventory contract labor and many more). In a downcycle, cyclical companies will try and reduce variable costs first, before reducing fixed costs. The fixed costs are seen as necessary to sustain the company over market cycles, so reducing those tends to affect revenue and earnings in the long run.

Once you have earnings/profitability and vision sorted out, the next is skin in the game. Skin in the game matters for profitable companies with little vision on earnings. The promoter's job is to ensure there is a long-term vision in the works. If the long-term strategy is sorted, then having a large skin in the game can be a deterrent to succession planning; notice how big tech companies in the developed world do not operate with the same expectations. Even if their long-term strategy is under attack, it is still a nuanced strategy. Having a promoter with a large amount of skin in the game, prevents others from forming and driving that strategy - the ownership of strategy is often lost if the people necessary to drive the strategy also don't have skin in the game. In short, skin in the game matters, but it matter more for vulnerable companies with no moat. For companies with a moat, it is less of a concern - a lot of modern day moats come from giving up stake to partners.

Then, the parameter that follows is stakeholder management. Promoters cannot look after investors alone at all times. In the worst case, they might look only after their own interest. In the other extreme, they are forced to address the needs of other stakeholders like counterparties, governments, employees and all that becomes a necessary part of the company's strategy, leaving very little profit in the hands of all investors. Highly regulated industries tend to demonstrate some of these issues with stakeholder management; the higher degree of regulation became a necessity because so many are involved. An easy way to assess friendliness to minority shareholders is dividends and buybacks.

@rk09 @agent_style 👆

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

Yes, if they don't communicate, there are a few implications.

The first, is that they don't do stakeholder management well. Minority shareholders are also a stakeholder. While the promoter has more visibility in what's happening in the business, the minority shareholder only gets to know more of the company through information released by the board. Thats information assymmetry, and it can hurt minority shareholders when they are not aware of things that affect their investment.

The second implication is that the relationship between the board and minority shareholders is adversarial. The promoter needs the minority shareholders to be a listed company and all the benefits that come with a listed company, but beyond that he doesn't think of them as partners of any sort. He/she is seen as first among equals - a portion of the revenue that comes into the company is taken out via expenses (personal salaries and expenses) by the promoter, and minority shareholders get whatever is left after all the other expenses are accounted. Sometimes, the profit in the hands of minority shareholders is negligible, when expressed as a percentage of revenue. Easier to not communicate any of this beyond regulatory needs, keep everyone in the dark, take money out legally, and give out morsels to the other folks on the cap table. That's why communication and accountability of the communicated material is important.

There are a few other implications as well, but not as important as these two.

So you are telling without a moat there would be in inherent risk of one of the partners becoming a competitor ?That';s possible. If the forces within an industry are such that any one can be your competitor, its possible your current employees at the executive level (CXOs) can become future competitors. Lots of stories to go around here.

Also dividends end up in promoters pockets too right? Can it necessarily classify as friendlinessYes. Dividends are paid out of cash reserves. The profit reported in your P&L doesn't get reinvested back into the company. At periodic intervals, the profits move into reserves. The reserve can be seen as a savings account for the company, to dip into whenever there is a necessity. When there is no necessity to maintain large reserves, shareholders do ask what the company is doing with it. If the company has no avenues to deploy the money, it is expected to be returned to owners. The company management is never seen as the best authority on deploying unused capital. The management is there to manage the capital that it needs to run the business, not the profits. This is the agency theory of capitalism at play - https://www.investopedia.com/terms/a/agencytheory.asp. If management was good at deploying left over capital outside the company (lot of companies make investments in mutual funds and other places), then they should start their investing business with separate funds, not run an internal investment company. The shareholders could instead take that money out and deploy it in other companies as they see fit - as owners they are after all entitled to the reserves. There is another point - the reserves exist on paper until there is evidence of it. It is very much possible for companies to inflate profits and thus reserves, when none of that is true. Giving money back to shareholders through dividends and buybacks is first and foremost, evidence of reserves. Additionally, these events are also evidence of stakeholder management and ethical management. The promoter can always take money out of the money; he's not just holding majority stake but also controls management. The minority shareholder just has a piece of paper with a promise to pay out future profits. Dividends and buybacks is how the minority shareholder sees that promise is fulfilled.

Unknown User•2y ago

Message Not Public

Sign In & Join Server To View

💬 3 🔁 9 ❤️ 36 👁️ 6.5K

FxTwitter / FixupX

Sharad Dubey (@Sharad9Dubey)

CAMPHOR PRICES RISE-SEEING INDIA CAMPHOR WPI DATA-TILL MARCH

PRICES EXPECTED TO RISE-IMPORTS FROM BRAZIL HAS BEEN LOW DUE TO LOWER SUPPLY

ORIENTAL ARO +20%

MANGALAM ORG +8%

KANCHEE KARP +12%

PRIVI +5%

CREDIT @Chins1729

CREDIT @Chins1729

@reo_sam Camphor prices jumped in previous quarter. Still at multi year lows.

There are some listed companies in this space that have already jumped 30-40%

💬 25 🔁 56 ❤️ 437 👁️ 43.5K

FxTwitter / FixupX

Tarun (@tarunmallappa)

If I said that, Britannia created share-holder wealth not by increasing revenue or adding new products but by optimising their truck utilisation capacity, you will mock me. But it's true. A story of picture-perfect execution in CPG business/.

- This P&L snapshot is from Britannia for 3 years over 16 years. 👇(It almost looks like an excerpt from...

@reo_sam Higher revenues from shipping, reported by GESHIP

No revenue growth this FY over previous FY though. Margins improved due to a few one-off items.

Price to NAV from the Investor presentation for GESHIP. Still trading below NAV, meaning underpriced, by traditional valuation measures.

Investor presentation - https://www.bseindia.com/xml-data/corpfiling/AttachHis/c642a27a-d089-41d7-9317-07baa9b907bf.pdf

💬 2 🔁 9 ❤️ 39 👁️ 3.9K

FxTwitter / FixupX

Hidden Monopolies (@SwitchCost)

This piece of research landed on my desk in 2002.

Since then, I have found it to be one of the most influential pieces I have read.

Since then, I have found it to be one of the most influential pieces I have read.

Book mentioned is available here - https://12mv2.com/wp-content/uploads/2024/04/02-12-16-measuring-the-moat__assessing-the-magnitude-and-sustainability-of-value-creation.pdf

The F-word: With Zomato giving up its PA licence, is finance-as-a-f...

Zomato’s decision to surrender its payments aggregator licence—which it only acquired in January—highlights the intense competition and challenges faced by late entrants in the finance sector. It also brings to the fore the reality that finance isn’t just a feature startups can simply tack on.

Ryan Petersen (@typesfast) on X

Global containerized ocean freight prices are surging to levels not seen since the pandemic supply chain crunch. Some key trade lane rates are up 140% since mid-December and increasing by the week. What’s happening, why, and what it means for businesses needing products moved? 🧵

Twitter

@reo_sam one more shipping update

This was expected. Only thing is whether that helps our companies.

@reo_sam Market doesnt seem to believe this shipping cycle is sustainable. Hence the valuations arent going up by much. Companies are also using the opportunity to clean the balance sheet by paring down debt. Can be seen in GESHIP and Scorpio Tankers (the NYSE listed co), both reducing their debt.

TradeWinds | Latest shipping and maritime news

Scorpio Tankers seals $223.6m debt repayment that slashes breakeven...

Gambit is seen as a key step in increasing cash flows, returning capital to shareholders

That is a good thing. Because eventually they will realise that these companies have a moat and the existing ones have a pricing power.

Yeah, so that needs lot more time to play out.

I dont see a shipping cycle crash in this year

Isn’t it fun to play out the longer cycles. Gives lot of time to accumulate and sit back.

Sometimes I think that the more stories there are about companies or sectors, more likely they are to go in a bear phase. While those having no stories, just make reasonable money.

Samhi Hotels reports PAT profitability for first time since IPO. Still a long way to go. Valuations might run up ahead of fundamentals though.

Unknown User•15mo ago

Message Not Public

Sign In & Join Server To View

I use Trendlyne. Screener requires a paid subscription for that feature

Unknown User•9mo ago

Message Not Public

Sign In & Join Server To View

So, employee costs for a business like Zomato are for their in-house employees. Not for delivery partners.

This is why they call them delivery partners, because they are contractors, and the income of partners comes out of the fee charged to customers

If you look at the actual count of employees, that doesnt scale linearly as the business. You dont need to add more engineers, sales and marketing folks, or other support functions, as you grow as a business.

Thats the second reason for employee cost as part of expenses to go down

There are other expenses that start to matter once business has to scale

This is notable for tech expenses. Those are usually front-loaded for a business.

The costs for hiring engineers in early stages is so high, but once the revenue scales up, there is no need to have the engineering team also grow linearly

For marketing and sales, it would depend on how the business scales horizontally across geographies

Generally, a company like Zomato would have city specific growth teams, and a management structure to support such teams

Beyond a point, growing geographically is about adding new teams for new geographies, with the management cost not scaling linearly

You should actually get a breakdown of the other costs, once people costs become less significant

Lot of shareholder-unfriendly costs are hidden by companies under such PnL heads

Unknown User•9mo ago

Message Not Public

Sign In & Join Server To View

Depends on their revenue recognition policy

Goodreturn

Zomato Ltd. Accounting Policies | Accounting Policy of Zomato Ltd.

Accounting policies of Zomato Ltd. Company including its revenue recognition, employee benefits, intangible assets and more.

This page looks like an extract from the annual report. So you should probably head there

This is how Zomato recognizes revenue -

The important part of that statement is this

amount of transaction price (net of variable consideration)

The term 'net of variable consideration' would mean the transaction amount or sale amount or payment amount for an order is not how Zomato recognises revenue

They net it off against the variable consideration, so you need to go and dig a bit further on what does into defining a variable consideration.Unknown User•9mo ago

Message Not Public

Sign In & Join Server To View

What they teach you in school is mostly theory

Unknown User•9mo ago

Message Not Public

Sign In & Join Server To View

Accounting policies dont serve as a regulation on how a business should operate. Sometimes, if something is not clear under law, the company would look to figure out what liabilities it would incur, instead of not operating at all. Laws, tax codes, financial reporting regulations take time to catch up with business reality.

@reo_sam

Container shipping rates for China-US links see a spike. This is from Drewry.

Rates are still at a bottom from last year.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

@Aaditya Aanand some feedback based on the limited time I've spent on this platform

The discovery screen looks like a differentiator compared to other platforms like Trendlyne

Now, with my exposure to LLMs, I would like to see if there is a way to confirm the stocks in the bucket are there for genuine reasons

I see you made some attempt with that, via these explainers.

But a link to the source material (exchange filings, annual reports, investor presentations or press releases) would be better, because it lends authenticity

On the same page, some of the companies would need filtering. For example, Sarda Energy and minerals is in the bucket because of a captive solar power plant. Captive plants only end up in cost reduction. They are not revenue accretive. So, not sure such companies should be in the bucket.

Maybe it would help if you start defining what goes into the bucket, and what is avoided, because there are companies that try to jump onto a bandwagon, in order to attract investors, despite little or no material impact on EPS.

You may also want to incorporate a negative filter or a ranking filter. For example, companies with corporate governances or fraud issues, should be ranked lower.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

Didnt really look much at the other features. They looked like baseline features foundi in other apps. I have an entirely different viewpoint around those features. For example, there are indicators used in technical analysis when viewing an individual stock. I would prefer these indicators not be mixed with other metrics. Wouldnt prefer that they be removed. Just that there should be a clear delineation between value and idea discovery (what fundamental analysis is better at), and pricing action (where technical analysis would do a better job at whether it is the right time to enter).

On analyst projections for the stock, it would be nice to know if a projection is realistic or not. Or at least provide pointers in a templatized format so that users can verify if the projection is realistic. Some projections are on the line of "If we aim for the stars, we'll at least land on Venus"

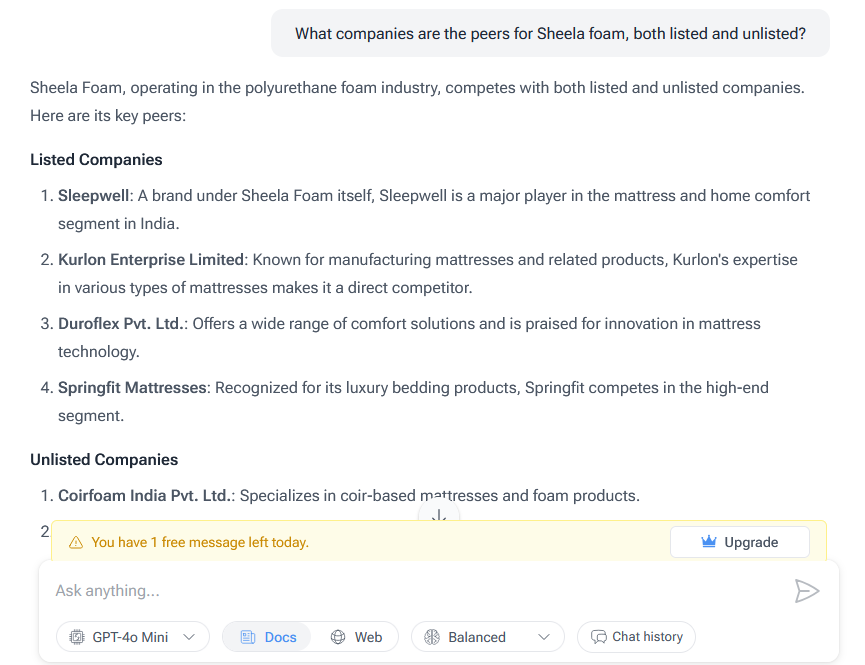

I just tried AI mode.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

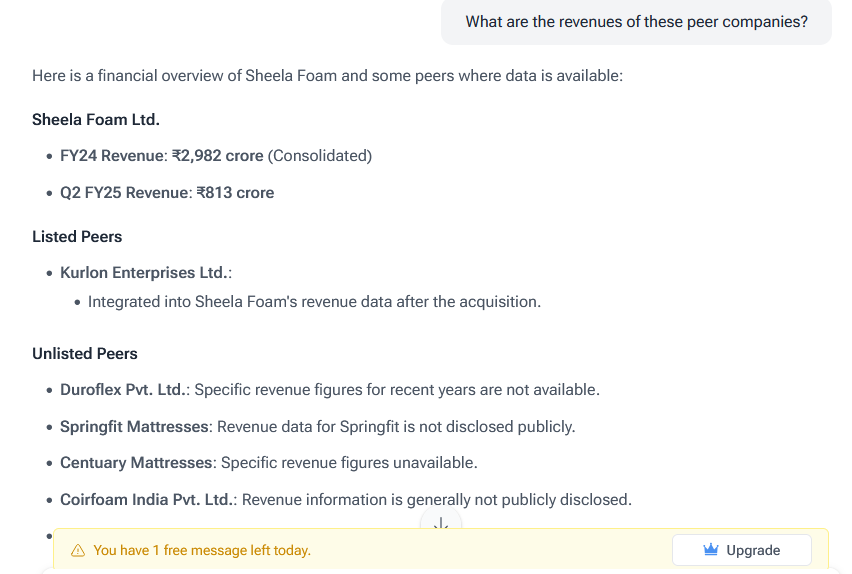

Looks interesting (AI mode), but have concerns over freshness of data. This one for instance, seems like 6-12 months old. And possibly incorrect. The response is correct around listed peer companies. Wakefit should be prominent unlisted peer. The Sleep company/Comfortgrid should be another. Some of these names could be extracted from conference call transcripts. Not sure how you are providing context to OpenAI; if it is RAG, then maybe you can find some interesting ways to provide additional context.

Sometimes it is useful to know about privately held company metrics. The financial metrics can come from MCA. In this screenshot, all of the privately held companies do not have data reported on the platform, which ends up triggering a new search for those via zauba or even the MCA site; its an expensive search as well because each filing costs a few hundred rupees at minimum.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

Ok, that looks a break in the product flow. Might affect only first time users of the app.

Also, I'm not sure MCA data will be available on any of the news sites. Usually they are very dated, sometimes around a year old. For example, some sites like Inc42 or Yourstory would report FY24 financials in FY26 and this gets indexed by search engines. MCA filiings for FY 25 would usually be available and more accurate.

But thats relatively a minor thing. Its really up to you if fact discovery can be done by users outside the platform and they use the platform for other reasons.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

@reo_sam @chasinglakshmi 👆

@Aaditya Aanand The screener functionality could do with a lot more work. I'm comparing this against Trendlyne and Screener.in, so a bit biased due to seeing other apps.

Creating usable screens would help for one. Both screener and trendlyne have partially solved this by providing existing screens with the logic behind them. Of course, it doesnt mean any user can immediately customize and make better stock screeners. Both of these apps ship with vetted templates. The value is not in the pre-existing screens, for the most part, except for some in Trendlyn that relies on their own proprietary metrics (the DVM scores).

Alerting is kind of important. Knowing that a stock exited or entered a screen is important for actionability - one should sell or buy a stock based on those triggers, or at least warrant further examination both fundamental and technical.

Trendlyne has a weakness in some of their pre-existing screeners though. When they reference the performance of the screener against an index, that data is relevant/valid only for past 6-12 months, since they dont seem to have data about the indices, only the individual companies. For example, if a screener were shown to outperform Nifty 500 in past 5 years, Trendlyne makes that claim based on 5 years of stock prices with the current Nifty 500 constituents, not the Nifty 500 or Nifty 500 TRI prices.

@Aaditya Aanand You should try asking in Valupickr forums as well.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

This is from a few weeks back. https://forum.valuepickr.com/t/proscreener-sharing-my-stock-analysis-tool-for-community-feedback/190774

ValuePickr Forum

ProScreener - Sharing my stock analysis tool for community feedback

Hi everyone, I’ve been using a tool called ProScreener for my own stock analysis, and I’m now opening it up to the community in its early stages. The idea behind ProScreener is simple: to help investors better understand stock performance by aggregating key metrics and presenting clear insights. The tool breaks down analysis into several p...

But maybe check with their moderators

There are posts by other users who've written other apps

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View

@Aaditya Aanand Ayush Mittal who owns/operates Screener.in is also on that forum as a moderator. Havent seen anything biased against other apps, but keep in mind the crowed might already be pro users of screener.

Unknown User•5mo ago

Message Not Public

Sign In & Join Server To View